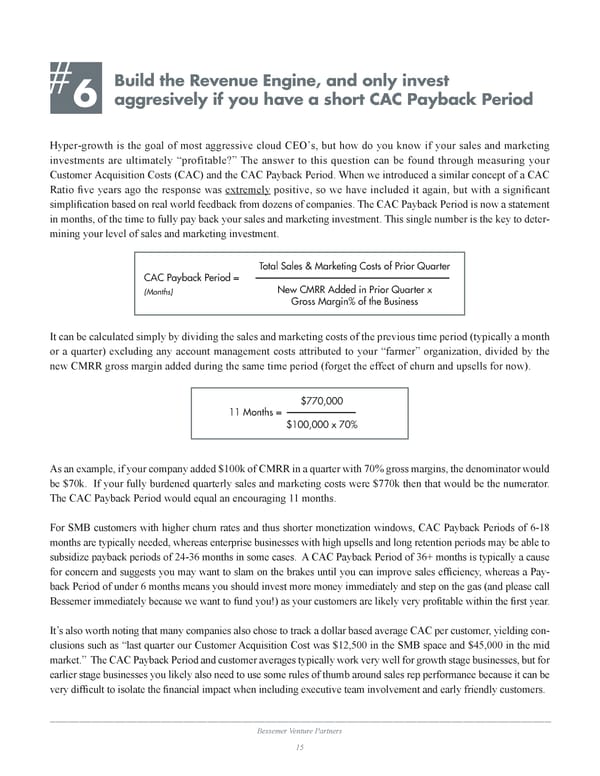

# Build the Revenue Engine, and only invest 6 aggresively if you have a short CAC Payback Period Hyper-growth is the goal of most aggressive cloud CEO’s, but how do you know if your sales and marketing investments are ultimately “profitable?” The answer to this question can be found through measuring your Customer Acquisition Costs (CAC) and the CAC Payback Period. When we introduced a similar concept of a CAC Ratio five years ago the response was extremely positive, so we have included it again, but with a significant simplification based on real world feedback from dozens of companies. The CAC Payback Period is now a statement in months, of the time to fully pay back your sales and marketing investment. This single number is the key to deter- mining your level of sales and marketing investment. Total Sales & Marketing Costs of Prior Quarter CAC Payback Period = (Months) New CMRR Added in Prior Quarter x Gross Margin% of the Business It can be calculated simply by dividing the sales and marketing costs of the previous time period (typically a month or a quarter) excluding any account management costs attributed to your “farmer” organization, divided by the new CMRR gross margin added during the same time period (forget the effect of churn and upsells for now). $770,000 11 Months = $100,000 x 70% As an example, if your company added $100k of CMRR in a quarter with 70% gross margins, the denominator would be $70k. If your fully burdened quarterly sales and marketing costs were $770k then that would be the numerator. The CAC Payback Period would equal an encouraging 11 months. For SMB customers with higher churn rates and thus shorter monetization windows, CAC Payback Periods of 6-18 months are typically needed, whereas enterprise businesses with high upsells and long retention periods may be able to subsidize payback periods of 24-36 months in some cases. A CAC Payback Period of 36+ months is typically a cause for concern and suggests you may want to slam on the brakes until you can improve sales efficiency, whereas a Pay- back Period of under 6 months means you should invest more money immediately and step on the gas (and please call Bessemer immediately because we want to fund you!) as your customers are likely very profitable within the first year. It’s also worth noting that many companies also chose to track a dollar based average CAC per customer, yielding con- clusions such as “last quarter our Customer Acquisition Cost was $12,500 in the SMB space and $45,000 in the mid market.” The CAC Payback Period and customer averages typically work very well for growth stage businesses, but for earlier stage businesses you likely also need to use some rules of thumb around sales rep performance because it can be very difficult to isolate the financial impact when including executive team involvement and early friendly customers. Bessemer Venture Partners 15

Bessemer’s Top 10 Laws of Cloud Computing Page 14 Page 16

Bessemer’s Top 10 Laws of Cloud Computing Page 14 Page 16